Elevating Stability in Financial Success

Blog

Transforming Record-to-Report with AI-Powered Matching Engines

The Reconciliation Challenge

Traditional reconciliation is a bottleneck. Finance teams spend an enormous amount of time manually matching complex transactions that standard rule-based software can't handle, delaying the financial close and increasing risk.

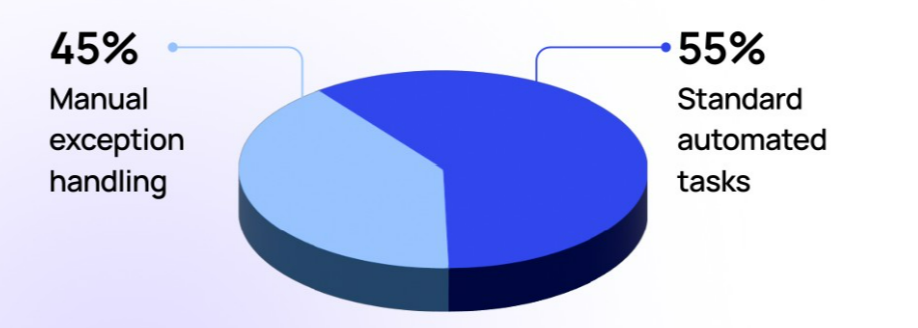

The Drain on Resources

Standard tools flag any exception, partial payments, currency fluctuations, data entry errors and hand the problem back to your team. This manual resolution of complex cases becomes a major time sink.

40-50% of total reconciliation resources are consumed by manual exception handling.

A Smarter Approach

The AI/ML-driven engine goes far beyond static rules. It uses a hybrid framework to automate both simple and complex transactions, learning from historical data to improve continuously.

The Old Way | The New Way |

Rigid Rules

| AI-Powered Engine

|

How The AI Engine Works

Our engine uses a two-pronged approach to maximize automation and accuracy, handling everything from simple one-to-one matches to complex many-to-many scenarios.

- Transaction Input : High-volume cash and payment data enters the system

- Deterministic Match : Applies rules for exact and tolerance-based matches. Clears simple transactions instantly

- Probabilistic Match : ML models analyze remaining data for likely matches based on patterns

- Reconciled : Transactions are matched, with minimal exceptions flagged for review

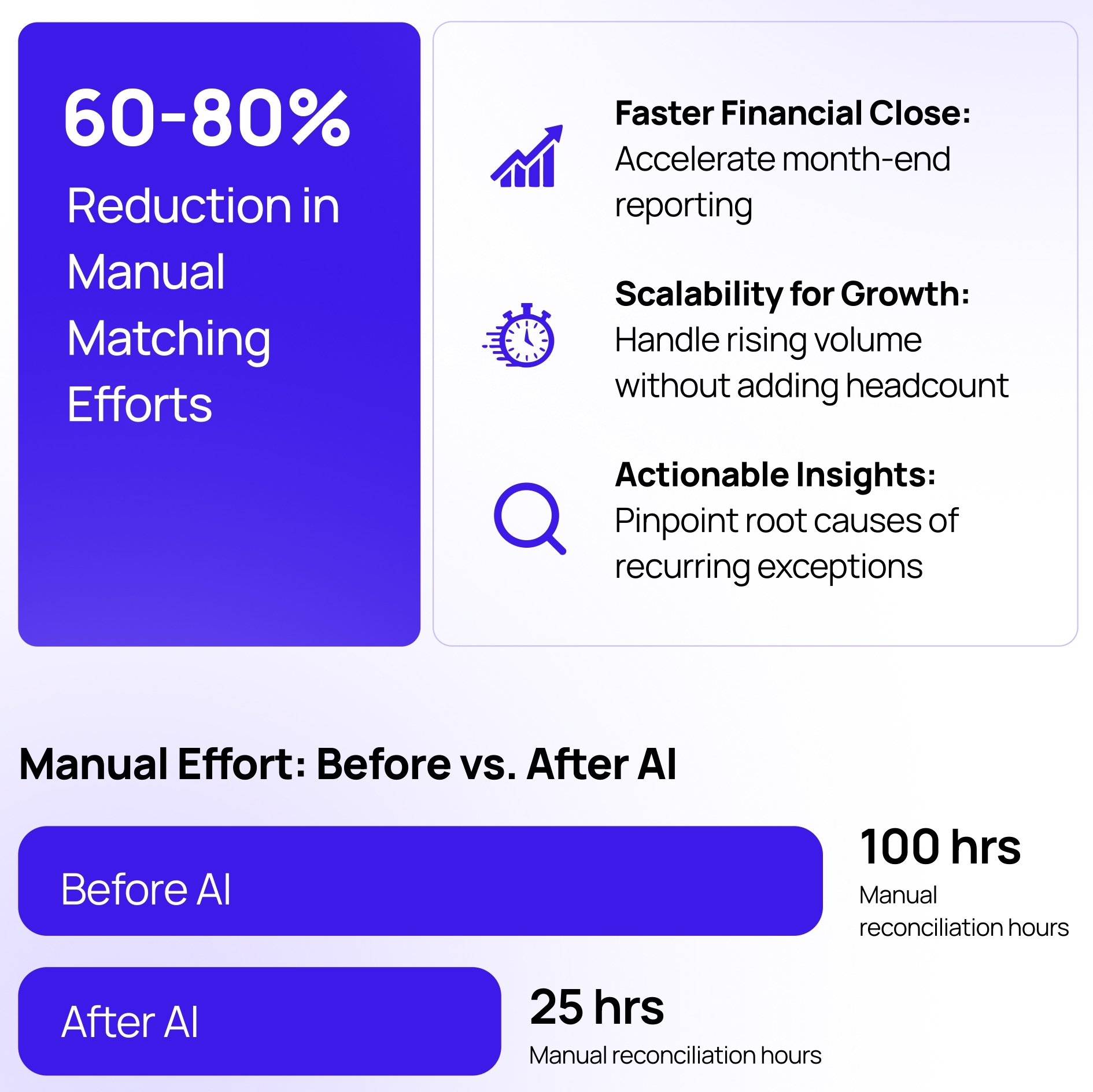

Quantifiable Business Benefits

Implementing an AI-driven engine delivers immediate and significant improvements to R2R operations, driving efficiency, accuracy, and scalability

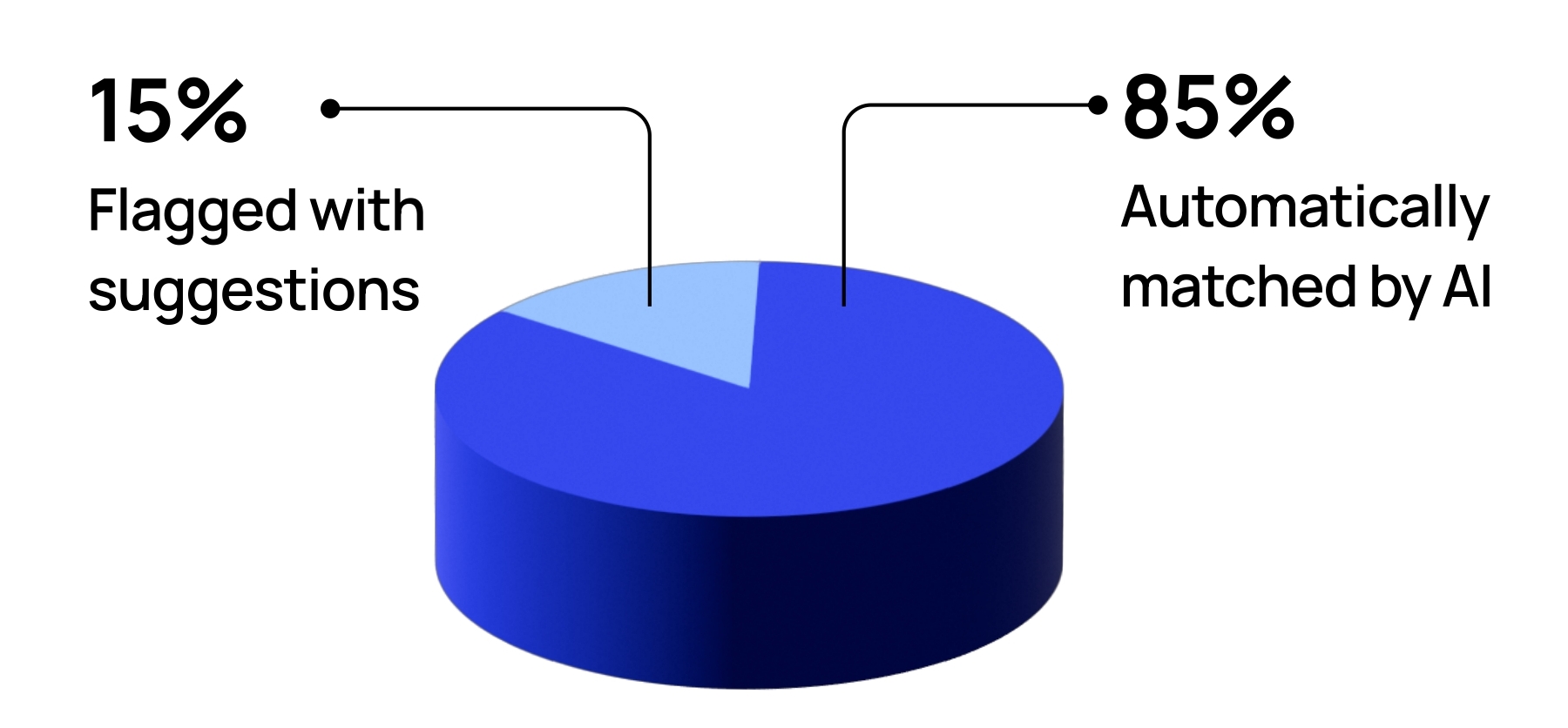

Real-World Impact

For a global enterprise, the system clears the vast majority of transactions automatically. This transforms the finance team's role from data entry to strategic analysis.

A Paradigm Shift in Operations

With automation handling the heavy lifting, your highly skilled finance professionals can dedicate their expertise to highvalue activities that drive business growth.

.png)