Elevating Stability in Financial Success

Blog

The working capital metrics that matters most to your business

Cashflow is the lifeline of any organization and what’s so new about this?

At least on some occasions this would have had a strain on working capital for many organizations. Companies that manage their cash efficiently can grow faster, invest in opportunities, and remain resilient during downturns.

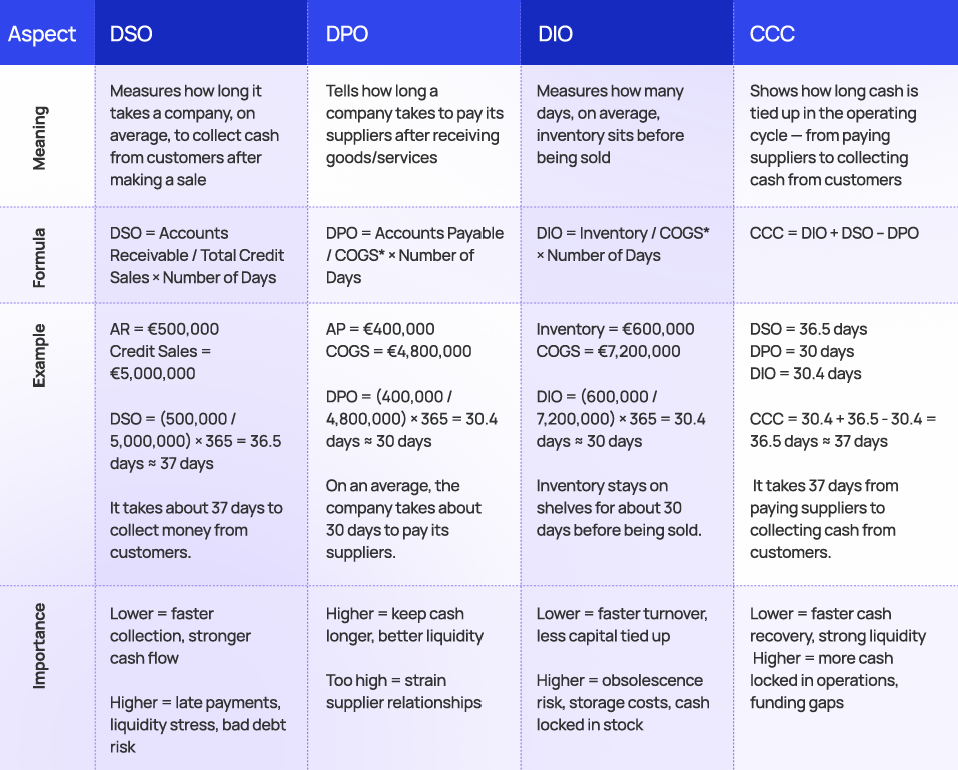

Four critical metrics indicate the health of the working capital process for a business. Together, these metrics provide a complete picture of how money flows through a company, from buying raw materials to selling finished products and collecting payments.

Here is how these metrics are interconnected.

A respectable amount of attention needed to be given to these metrics to ensure better working capital management and in turn sufficient cash flow. So, any advancements that can help take the pressure out of AR, AP workflows is always welcomed by the FP&A teams.

* COGS - Cost of Goods Sold

Notes:

- While standard formulas are widely used, companies often adapt their calculations for DSO, DPO, and DIO to align with their specific business models and industry practices.

- Inventory is valued at cost (what it took to acquire or produce), not at the selling price. It stays at cost unless market value drops, in which case it’s written down to the lower value.

.png)